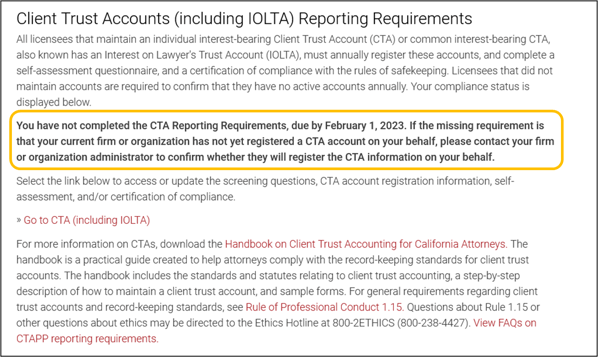

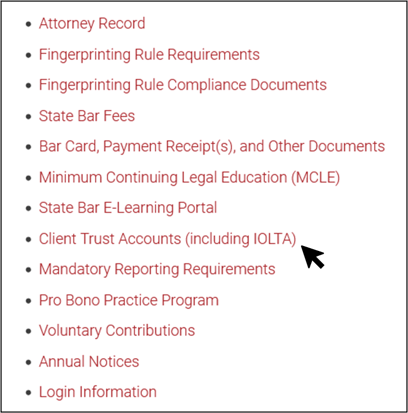

To update previously reported client trust account (CTA) information (including IOLTA), click the "Client Trust Accounts (including IOLTA)" link in your profile menu.

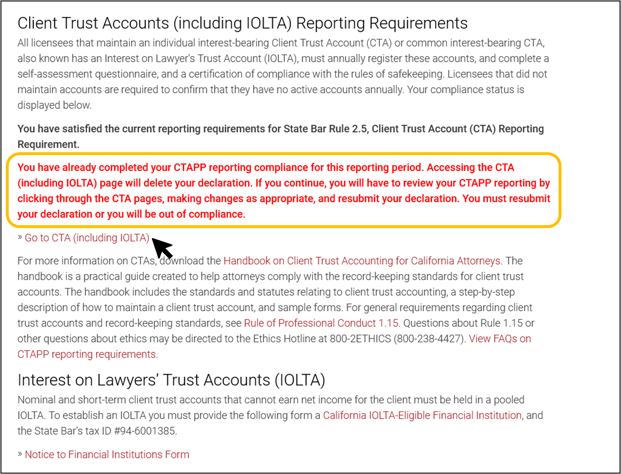

Under the "Client Trust Accounts (including IOLTA) Reporting Requirements" heading, click "Go to CTA (including IOLTA)" to update previously reported CTA information.

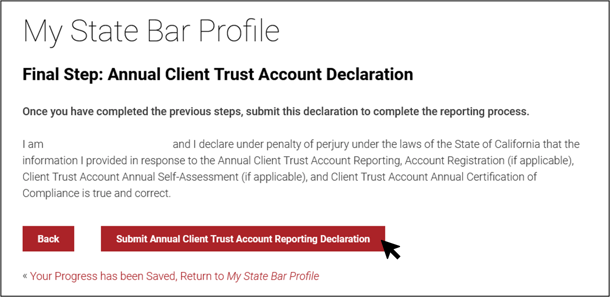

Please note: Accessing the CTAPP reporting requirements pages after you have completed your CTAPP reporting compliance for the reporting period will delete your previously completed "Final Step" declaration. If you proceed to the CTAPP reporting requirements pages to update previously reported CTA information, you will be required to click through all the CTAPP pages, make the changes where required, and then resubmit your "Final Step" declaration. You must resubmit your declaration or you will be out of compliance.

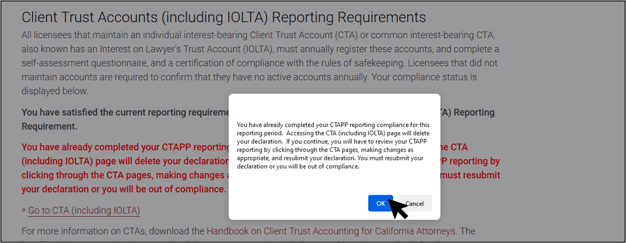

After clicking "Go to CTA (including IOLTA)", a pop-up will display notifying you again that if you proceed you must resubmit your declaration or you will be out of compliance. Click "Ok" to proceed.

Make the appropriate changes throughout the CTAPP reporting requirements pages as required.

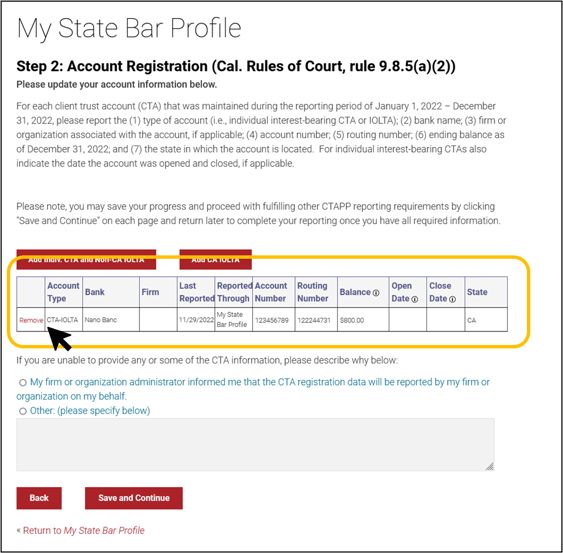

Please note: If you need to edit or update previously reported CTA information on the "Step 2: Account Registration" page, you must click the "Remove" option to delete the account information entirely and then re-enter the account information with the required updates as new by selecting either the "Add Indiv. CTA and non-CA IOLTA" or "Add CA IOLTA" button.

Once you have updated all required information, click "Next" on the Self-Assessment page and "Save and Continue" on the Review Self-Assessment and Certification of Compliance pages, and resubmit your annual CTA declaration before returning to your My State Bar Profile.

Please note: If you fail to resubmit your declaration, your CTAPP compliance status will update to indicate you are not in compliance.