Complete your CTAPP reporting

Learn how to complete your Annual Renewal Client Trust Account Protection Program (CTAPP) reporting requirement.

What is CTAPP?

CTAPP is a proactive regulatory requirement designed to:

- Protect the public by ensuring proper accounting and safeguards for client and third-party funds entrusted to attorneys; and

- Educate, support, and assist attorneys in complying with the ethical and accounting requirements of managing client trust accounts.

CTAPP reporting may include:

- Confirming whether you were responsible for client trust funds during the reporting period

- Registering client trust account information (if required)

- Completing a trust account self-assessment (if applicable)

- Submitting a final certification and declaration

Who is Required to Complete CTAPP?

You must complete CTAPP annual reporting if you:

- Are active or not eligible.

- You are inactive but were active at any time during the reporting period of January 1 – December 31, 2025.

Note: Even if you did not handle client funds, you are still required to complete CTAPP reporting.

When is CTAPP Annual Reporting Due?

CTAPP reporting is completed as part of the Attorney Annual Renewal.

- Annual Renewal opens: February 1

- Deadline to comply: March 30

Failure to complete CTAPP reporting by the deadline may result in noncompliance penalties.

Before You Begin

Before starting CTAPP reporting, keep the following in mind:

- CTAPP is completed online through My State Bar Profile.

- The accounts required to be registered depend on your responses to initial questions.

-

You are responsible for ensuring all required accounts and balances are registered by the March 30 deadline. Even if your firm registers the required account details through Agency Billing, incomplete information may result in noncompliance penalties, even if you have submitted your Final Declaration.

CTAPP Reporting Overview

Most attorneys will complete CTAPP by completing the following:

- Part A: Access CTAPP Annual Reporting

- Part B: Answer the initial screening question

- Part C: Answer Step 1 reporting questions (if applicable)

- Part D: Step 2 register required trust account information (if applicable)

- Part E: Complete Step 3 self-assessment (if applicable)

- Part F: Complete Step 4 annual certification (if applicable)

- Part G: Submit the final declaration to complete the reporting process

- Need help? Common Issues and FAQs

You may watch the video below for help with the Screening Question, Step 1, and Step 2 or follow the step-by-step instructions below to complete your reporting.

Part A: Access CTAPP Annual Reporting

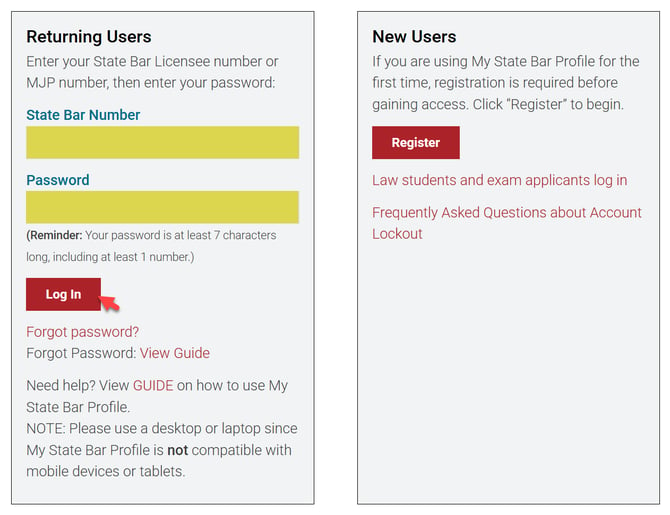

Go to My State Bar Profile and sign in using your bar number and password.

Forgot your password? View this guide. Do not remember your bar number? View this guide.

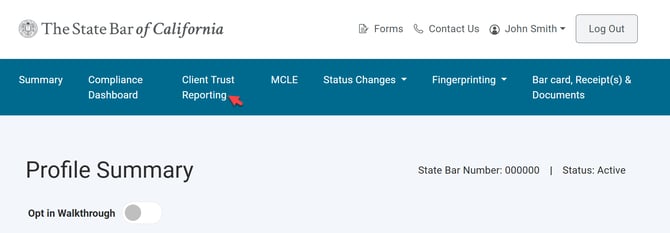

From the main navigation bar at the top of your My State Bar Profile Summary page, select “Client Trust Reporting.”

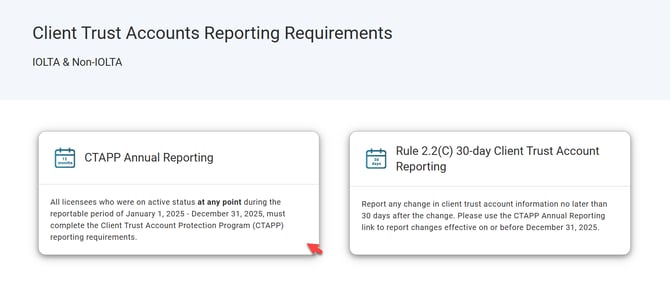

On the "Client Trust Accounts Reporting Requirements" landing page, click the "CTAPP Annual Reporting" option to begin your reporting.

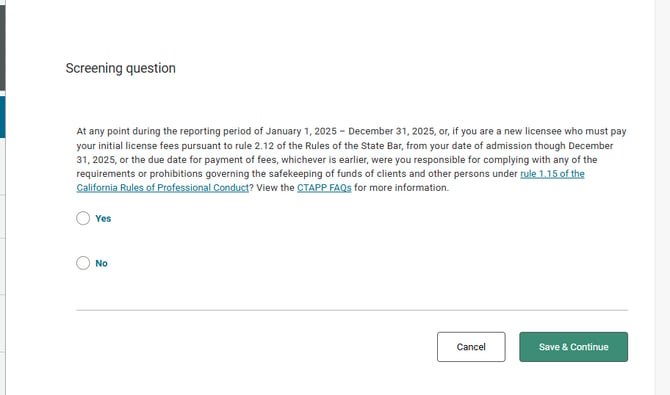

Part B: Answer the initial screening question

- If you answer yes, you must complete the remaining steps of the CTAPP annual reporting process.

- If you answer no, you may proceed directly to submitting the Final Declaration, unless you have registered accounts. If any accounts are registered, you will be directed to Step 2 and you must disassociate or close the accounts before submitting the Final Declaration

Part C: Answer Step 1 reporting questions

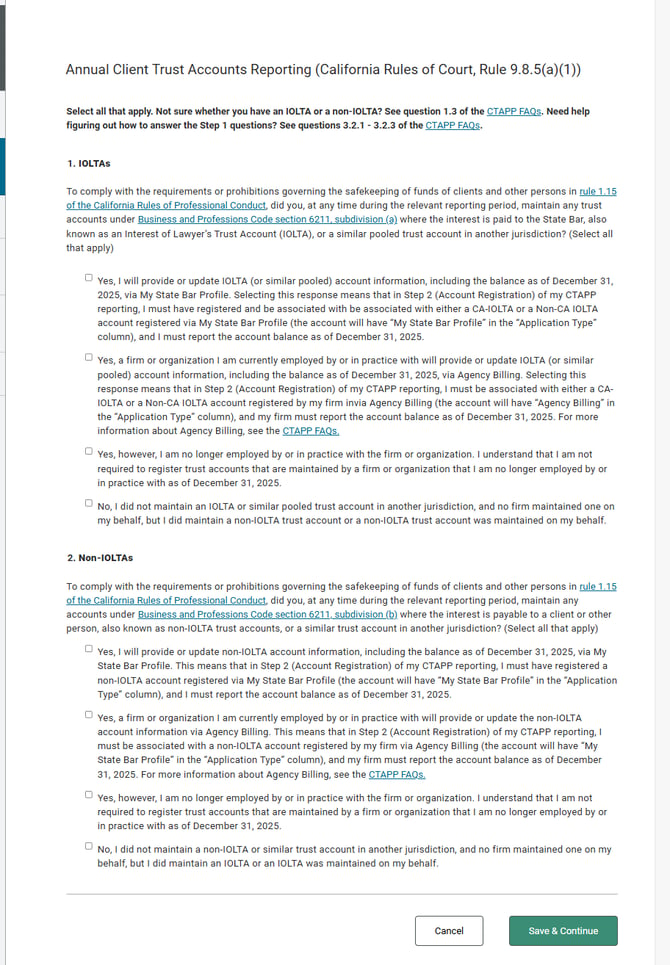

Step 1 requires you to respond to two reporting questions about whether you maintained, or your firm maintained on your behalf, IOLTAs and/or non-IOLTAs during the reporting period. Select applicable options and click "Save & Continue" to proceed.

Note: Based on your Step 1 responses, you must register the indicated accounts through the specified application. Your CTAPP reporting will not be considered complete until you fulfill the account registration requirements according to your Step 1 responses, even if you have submitted the Final Declaration.

-

IOLTA Accounts

- If you maintained the IOLTA account and you selected that you would provide required account information via My State Bar Profile, a CA-IOLTA or Non-CA IOLTA account must be registered through My State Bar Profile with the December 31 ending balance reported. Your firm cannot report this information on your behalf via Agency Billing.

- If your current firm/organization maintained the IOLTA account and you selected that your current firm would provide the required account information via Agency Billing, the CA-IOLTA or Non-CA IOLTA account must be registered through Agency Billing with the December 31 ending balance reported. You cannot report this information through My State Bar Profile.

-

Non-IOLTA Accounts

- If you maintained the Non-IOLTA account and you selected that you would provide required account information via My State Bar Profile, the Non-IOLTA account must be registered through My State Bar Profile with the December 31 ending balance reported. Your firm cannot report this information on your behalf via Agency Billing.

- If your current firm/organization maintained the Non-IOLTA account and you selected that your current firm would provide the required account information via Agency Billing, the Non-IOLTA account must be registered through Agency Billing with the December 31 ending balance reported. You cannot report this information through My State Bar Profile.

Important: It is your responsibility to ensure that all required accounts are registered. CTAPP reporting will remain incomplete until all necessary account information is accurately submitted.

Part D: Step 2 register required trust account information

Step 2, if applicable, requires that you register accounts maintained during the reporting period.

Note: Based on your Step 1 responses, you must register the indicated accounts through the specified application. Your CTAPP reporting will not be considered complete until you fulfill the account registration requirements according to your Step 1 responses, even if you have submitted the Final Declaration.

-

IOLTA Accounts

- If you maintained the IOLTA account and you selected that you would provide required account information via My State Bar Profile, a CA-IOLTA or Non-CA IOLTA account must be registered through My State Bar Profile with the December 31 ending balance reported. Your firm cannot report this information on your behalf via Agency Billing.

- If your current firm/organization maintained the IOLTA account and you selected that your current firm would provide the required account information via Agency Billing, the CA-IOLTA or Non-CA IOLTA account must be registered through Agency Billing with the December 31 ending balance reported. You cannot report this information through My State Bar Profile.

-

Non-IOLTA Accounts

- If you maintained the Non-IOLTA account and you selected that you would provide required account information via My State Bar Profile, the Non-IOLTA account must be registered through My State Bar Profile with the December 31 ending balance reported. Your firm cannot report this information on your behalf via Agency Billing.

- If your current firm/organization maintained the Non-IOLTA account and you selected that your current firm would provide the required account information via Agency Billing, the Non-IOLTA account must be registered through Agency Billing with the December 31 ending balance reported. You cannot report this information through My State Bar Profile.

Important: It is your responsibility to ensure that all required accounts are registered. CTAPP reporting will remain incomplete until all necessary account information is accurately submitted.

If needed, you may go back to Step 1 to update your response.

- View how to add a new account.

- View how to report the required balance for previously registered accounts.

- View how to report that a previously registered account is now closed

- View how to report that you are no longer associated with an account that was previously registered

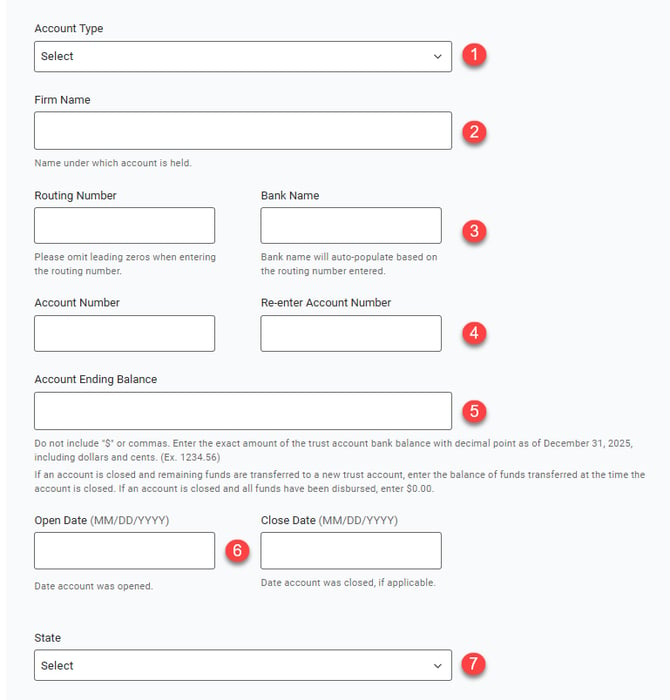

Adding accounts

In Step 2, click "Add Account" to register a new account.

To add a new IOLTA, non-CA IOLTA, and/or non-IOLTA account, you must:

- Select the account type (IOLTA, non-CA IOLTA, or non-IOLTA).

- Enter the firm name or organization associated with the account.

- Enter the account routing number.

- Enter the account number.

- Enter the account ending balance as of December 31, 2025. Note, you are not required to provide the account ending balance when adding an account, however, you will be required to provide the ending balance as of December 31, 2025 prior to submitting your final declaration.

- Enter the date the account was opened.

- Enter the state account is held.

Note:

- You must select the account type before entering any other account information.

- When entering the routing number, you must click the appropriate bank from the drop-down list presented. Doing so will automatically populate the Bank Name field. Please note that the Bank Name field is not a user editable field and is required to "Save & Continue." If you are unable to click the bank name from the drop-down list, you may also make your selection by using the down arrow on your keyboard and then press enter to make your selection.

Click "Save & Continue" to register the account. Click "Cancel" to return to the previous page without registering any account information.

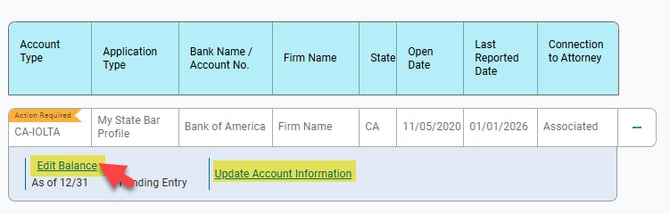

Editing accounts

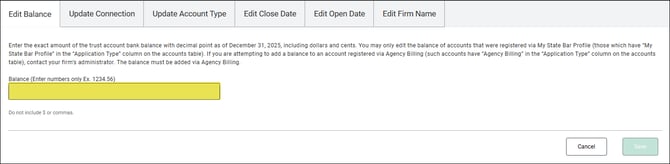

Next, a pop-up will appear with your options, on the "Edit Balance" tab, enter the required account ending balance as of December 31, 2025 and then click the "Save" button to register the information for the selected account.

Note: The ending balance entered must be the exact amount of the trust account bank balance as of December 31, 2025.

Note:

- If your account was previously registered as a "Ind. CTA or Non-CA IOLTA" account type, you will be required to update your account type to IOLTA, non-CA IOLTA, or non-IOLTA.

- If you were not previously required to provide an open date, you will now be required to provide the open date.

Click "Save" to register your updates. Click "Cancel" to return to the previous page.

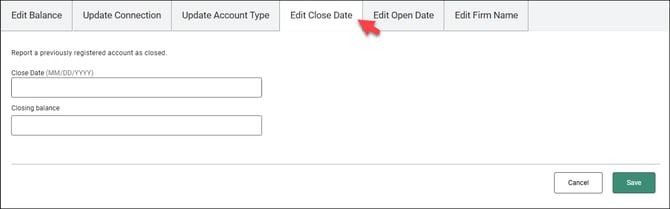

Report that a previously registered account is now closed

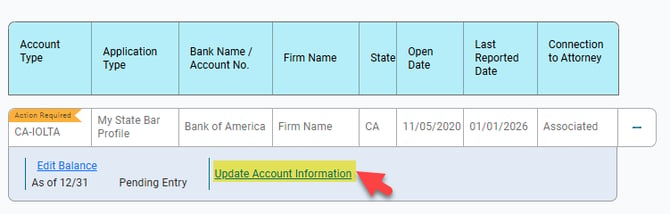

In Step 2, find the previously registered account that you now need to report as closed, and select the “Update Account Information” link for that account.

On the "Edit Close Date" tab, enter the date the account was closed and the account balance on date account was closed.

Note: If you report a close date beyond the 30-day requirement, you will need to provide an explanation for the late reporting.

After entering the required closing information, click "Save" to save your changes.

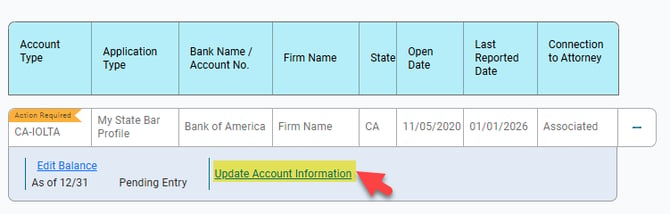

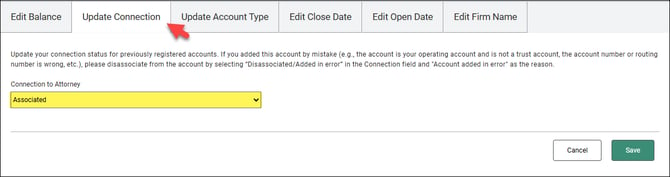

Report that you are no longer associated with an account that was previously registered

If you need to report that you are no longer associated to an account, either because the account was transferred to another attorney or you are no longer affiliated with the firm that reported the account on your behalf, you can report the disassociation by updating the "Connection to Attorney" status to disassociated.

To update a connection to disassociated, in Step 2, find the previously registered account that you now need to update, and select the “Update Account Information” link for that account.

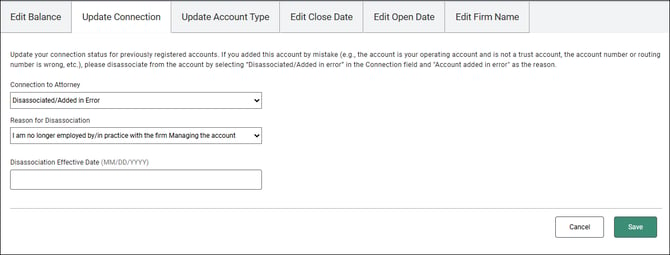

On the "Update Connection" tab, update the "Connection to Attorney" to "Disassociated."

Note: If you added an account in error, you can also use the "Connection to Attorney" option to indicate that the account was added in error and should be disassociated.

Once you have updated the "Connection to Attorney" status to disassociated, choose one of the following reasons for disassociating from the account:

- I am no longer employed by/in practice with the firm Managing the account

- I sold my practice

- Account added in error

- Other (if selected please provide additional details for the reason for disassociation)

Finally, provide the effective date of the disassociation in the "Date Disassociation Effective" field and click "Save" to save your changes.

Note: If you report a disassociation effective date beyond the 30-day requirement, you will need to provide an explanation for the late reporting.

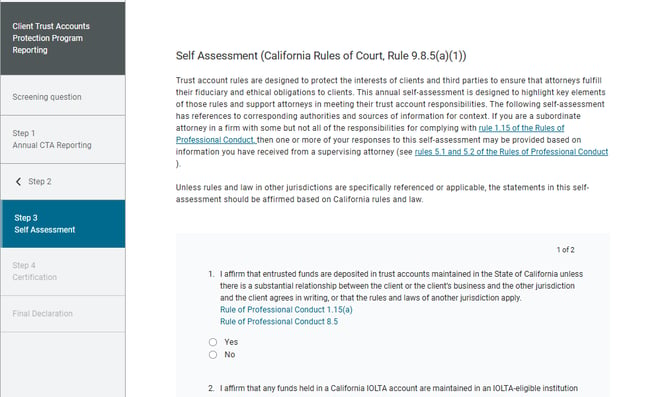

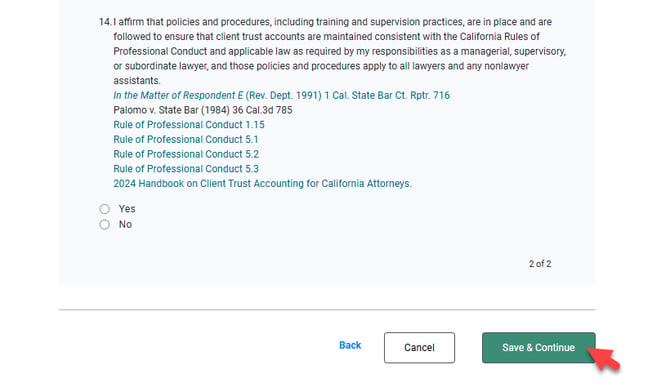

Part E: Complete Step 3 self-assessment

Step 3, if applicable, requires you to complete an annual self-assessment of client trust account management practices. Links to corresponding authorities and sources of information are provided for context.

Note: If you are a subordinate attorney in a firm with some but not all of the responsibilities for complying with rule 1.15 of the Rules of Professional Conduct, then one or more of your responses to this self-assessment may be provided based on information you have received from a supervising attorney (see rules 5.1 and 5.2 of the Rules of Professional Conduct).

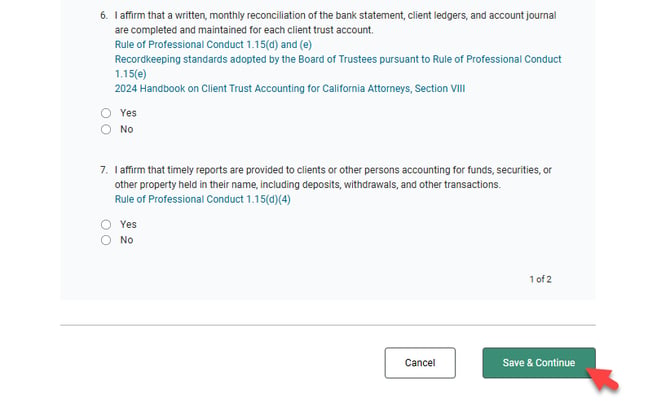

The self-assessment questions are divided across two pages. Click "Save & Continue" to save your page 1 responses and proceed to the second page.

Once you have responded to all the self-assessment question, click "Save & Continue" to proceed.

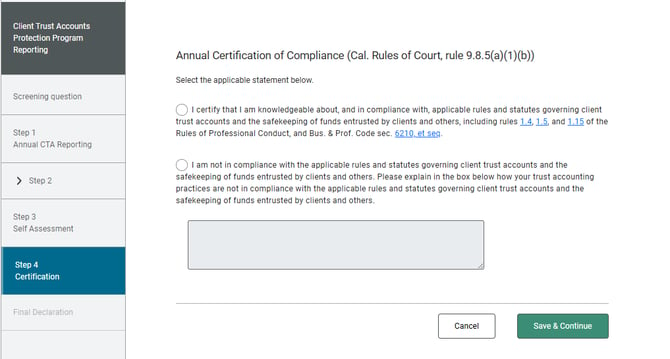

Part F: Complete Step 4 annual certification

Step 4, if applicable, requires that you certify with the State Bar that you understand and comply with requirements and prohibitions applicable to the safekeeping of funds and property of clients and other persons, including rules 1.4, 1.5, and 1.15 of the Rules of Professional Conduct and selected Business and Professions Code sections. Select the applicable statement.

Click "Cancel" to return to the previous page. Click "Save & Continue" to save your progress and continue to the next step.

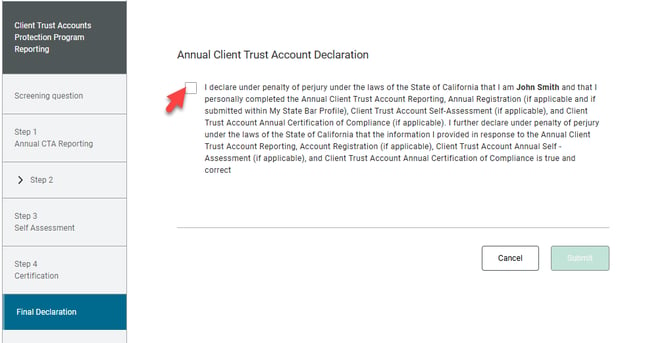

Part G: Submit the final declaration to complete the reporting process

The Final Step, requires that you submit the annual declaration. Check the box declaring under penalty of perjury that you personally completed the reporting requirements and enable the "Submit" button.

Click "Submit" to complete your CTAPP reporting requirements.

Check your Compliance Dashboard to see if you have any outstanding requirements.

Need help?

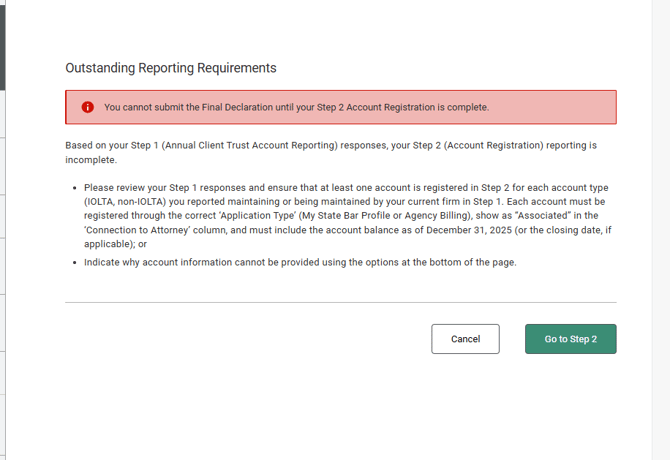

Why can't I submit the Final Declaration?

You will not be able to submit the Final Declaration if, based on your Step 1 responses, required accounts have not been registered, or if you have not indicated in Step 2 why the account information cannot be provided.

Review your Step 1 responses and confirm that at least one account is registered in Step 2 for each account type you reported maintaining. If account information cannot be provided, select the applicable option at the bottom of the page.

For additional help, please refer to:

Questions? Contact us.

![CA-StateBar_Logo_Horizontal_White_LargeSeal_.png]](https://info.calbar.ca.gov/hs-fs/hubfs/CA-StateBar_Logo_Horizontal_White_LargeSeal_.png?height=50&name=CA-StateBar_Logo_Horizontal_White_LargeSeal_.png)